The once dominant lead battery industry has approached the biggest crossroads in its 160-plus-year history. ‘Clean’ lithium-ion is used in the majority of energy storage systems, and is making in-roads on the SLI market. Paul Crompton asks the experts if it’s more important the lead battery industry focuses on performance-boosting R&D or shakes off its ‘dirty’ reputation to secure its future.

At its peak in 2004, Blockbuster— the America-based provider of home movie and video game rental services— had more than 50 million members worldwide.

A decade later the last of its 9,094 stores closed. A number of factors contributed to its demise; the main reason was its failure to adapt to a changing retail environment where streaming movies made renting physical DVDs feel archaic.

In short, no matter how well a business model is growing, it should never rest on its laurels. For the lead-acid community, the story of Blockbuster is pertinent because lithium-ion has the potential of being the Netflix of the battery industry.

Changing consumer needs and developing political commitments— the Paris Agreement, or ICE engine bans, for example— mean the battery of yesterday may not be the technology-du-jour for the next decade.

Traditional lead battery companies are introducing lithium-ion arms to their business model— if they haven’t already. High-end SLI batteries use lithium-ion technology; in the US, industry analysts IHS Markit predict that 90% of the 5GW of energy storage set to be deployed up to 2023 will use lithium-based batteries.

The reasons for the shift toward lithium-ion include: overall cost of ownership, higher energy densities, and lead having a reputation of being a pollutant.

The first two reasons are an R&D matter, and lead battery companies are working to improve dynamic-charge-acceptance, cycling performance and controlling overcharge— to name a few areas. Initiatives, such as the Consortium for Battery Innovation’s technical roadmap, have laid the foundations of an industry-wide drive to meet short-term goals and performance targets for lead batteries used in automotive and energy storage applications.

The final challenge might be harder to overcome. In 1895, Louis Hubert Gonzalve Lyautey (a French general and colonial administrator) used the phrase ‘hearts and minds’ as part of his strategy to counter rebellion along the Indochina-Chinese border. The term referenced a method of bringing a subjugated population onside, and was used many years later by former US president George W. Bush about the ‘war on terrorism’.

In the battery industry, the phrase can be used to mean winning back the general public’s trust in the product: the trust of people living in the vicinity of Exide’s former recycling plant in Vernon, for example; or those in Owino Uhuru— the Kenyan village contaminated by a recycling facility; or any one of many communities across developing countries. But the battle will only be won with the right policies, procedures and desire.

To this end, BEST asked key companies working in the lead battery industry one question: “Is the future of the lead battery industry reliant on changing people’s opinions (of it being a health risk) or on technological advancements (so it’s performance can compete with lithium-ion)?”

Here is what they said.

Terry Murphy, president and CEO of Hammond Group. The specialty chemical company’s mission is to make lead-acid batteries the competitive choice among “advanced batteries” in motive and stationary applications.

“Yes! The future of lead batteries requires both a changed public perception and technical advances to compete with lithium-ion. And we suspect this will occur, and via a two-way feedback mechanism where technical advances will improve public perception and an improved public opinion will spur further technical advances.

“If that seems unlikely, consider its opposite in today’s overwhelming public support for lithium-ion. Revolutionary mobile applications enabled by lithium-ion’s unprecedented energy density have effectively muted all legitimate concern for its operating safety, non-recyclability, unsustainability, and problematic raw materials. These problems will not change public opinion until it is technically and economically challenged.

“While all dispersive uses of lead— gasoline, paint and plumbing— have long ceased and lead batteries now quarantine lead in hermetically sealed plastic boxes in a near-perfect cradle-to-cradle worldwide recycling loop, public opinion remains antagonistic. The opportunity-cost of this attitude is that for renewable energy storage, where weight and energy density are less important than unit cost, technically advanced lead batteries could be the market leading technology in reducing CO2 emissions.

“And yet, because lead chemistry is an old technology— one where the full utilisation of its active materials was not a key requirement— there remains ‘low-hanging fruit’ to be exploited. Our focus has been on chemistry changes and additives to increase cycle-life and charge acceptance— and we have more technological advancements in the pipeline. Active health monitoring has shown to significantly increase battery life, while a configuration change to a bi-polar architecture would make lead batteries very competitive with lithium-ion at the systems level, as lead batteries are safer, cheaper, and sustainable. This must be the feedback mechanism to change public opinion, or we will all be paying the economic and environmental cost of the ‘regrettable substitution’ of lithium-ion, where the ‘new’ technology is more harmful than the old.

“The task to change public perception and advance lead technology should not be left on the shoulders of BCI, ILA, and CBI but be a key initiative for every lead-acid battery manufacturer and supplier. That means shifting the industry’s conservative mindset focused on ‘no changes’ and ‘cost reductions’ to embracing innovation, driving change, and investing in the real green electrochemistry— lead batteries.”

Doug Bornas, president MAC Engineering. Mac has been manufacturing machines for the lead battery industry for more than 50 years.

“The battery industry has tried to change people’s opinion about lead and health issues for a long time and have had varying degrees of success. Although we will never be able to stop spreading this truth through the industry, the fact is lead and people’s perception are difficult to change.

“I believe that technological advances of our batteries (to be more competitive with lithium) need to be the focus of this industry as well as keeping everyone aware that recyclability and cost is on the side of the lead-acid industry.

“I believe that if battery manufacturers continue to work on improving the capabilities, machine and material suppliers continue to work on developing products that the manufactures can use to produce higher quality batteries, this combination will resonate with the public and keep lead-acid batteries out in front of the market where they have been for a very long time. We cannot stop advancing our products or we will face the possibility of falling behind lithium-ion.”

Ian Klein and Dr Rainer Bußar: R&D managers at Penox’s. Penox has developed specialised chemicals dedicated to energy storage solutions since 2005.

“The future of the lead-acid battery industry will highly depend on the economic success and the ability of the industry to provide sustainable customer value— a reliable and cost-efficient product, designed for different market needs.

“Markets are driven by technical needs and regulated by political decisions as well. The future, therefore, depends on a combination of advancements in critical performance parameters on one side, and public perception of risks, related to lead-acid batteries, on the other.

“Politics always depends on the public opinion and votes of the people. The latter develop their opinion based on public information and campaigns driving political initiatives. If such communication initiatives are not based on a fair comparison of facts, they will fail— at least after some time. Hence, it is important that the lead-acid battery industry supports an open and honest communication policy, which also addresses weaknesses of the present technology. At the same time, focus should be on solutions for these shortfalls.

“For instance, the recent discussion of ecological damage and risk for the health of people in the recycling of lead-acid batteries in certain countries requires political attention and actions by the lead-acid battery industry in parallel. Solutions to recycling lead-acid batteries with minimal environmental impact do exist, and have to be promoted strongly, and furthered by the entire lead-acid battery community. Therefore, the future risk associated with lead-acid batteries can be significantly decreased worldwide— which is a message of hope.

“In short, a technology can never rely only on a sound or good performance, but also needs a good public reputation. Keeping both requires constant development, as well as adjustment of the technology on changing needs and also on changing political targets.”

Massimiliano Ianniello, Sovema’s general manager. The Italian firm is a supplier of machinery for lead-acid battery production.

“The cost-performance-recycling factor will still be an advantage for the lead industry in many applications. However, in the mid-long term, the performance factor will be the driver that will prevail in defining the leading technology, following the requirements of the devices that will be subject to electrification. The scale-up will do the rest to cut down the manufacturing costs.

“As a result, I do not believe that the ‘health risk’ will be a determining factor for the future of the lead-acid industry. This aspect can be managed by abiding by the environmental safety regulations.

“I rather believe that the socio-economic changes in the near future will foster such changes in behaviour and innovations to force the industry to make available technologies with adequate performances. As a consequence of this response to the market’s performance requirements, the choice of the best (or leading) battery technology will be done.”

Andy Bush, managing director of the International Lead Association, which represents lead producers globally.

“The impetus is on the industry to keep innovating and ensure the next generation of batteries meets the needs of customers, and continues to improve.

“That’s exactly where the focus is, of organisations such as the Consortium for Battery Innovation. Working with universities, manufacturers and government bodies, it is helping usher in the next level of lead battery performance, based on feedback and customer demand. And that demand is growing across all applications.

“Lead batteries remain around 70% of the worldwide rechargeable battery market. Chemistries such as lithium are growing fast, but worldwide demand for reliable battery energy storage is also growing at such a rate the market needs battery manufacturers and technologies capable of operating at scale to meet that demand. In that sense, only lead and lithium are currently capable of achieving that.

“There are negative perceptions about lead batteries, and we do have to address those— particularly in discussions with policy-makers, regulators and legislators. The problem is that those perceptions are often just that: views based on often-out-dated assumptions, and without any basis in reality.

“One of our most important tasks is to support efforts to engage with and influence policy-makers and legislators to explain clearly the actual role lead batteries play across industry and society; and to outline the key role they have supporting greater electrification and decarbonisation. And we need to demonstrate very clearly the value— and importance— of the product across the many applications we serve.

“There is inevitably far more excitement and a buzz around new technologies and capabilities, but lead batteries continue to be the reliable mainstay technology, and the potential for more innovation and future development remains highly significant. Of course, lead batteries also sit comfortably within a wider eco-system of different battery chemistries serving multiple customers’ needs.

“So yes, inaccurate perceptions matter and need to be addressed. But ultimately the market will decide based on technological performance and the ability to perform and meet customer requirements. Therefore, innovation and continuous improvement must remain hallmarks of the industry for the next decade and beyond, hand-in-hand with effective communications and advocacy.”

Dawn Heng, marketing director at lead-acid and lithium-ion battery separator firm Daramic.

“In the past couple of years, we’ve seen aggressive electrification and a wave of electric vehicle policy roadmaps for a 2030-2040 timeframe, especially in European and Asian countries. In the US, regulation is driving new energy storage demand in states like California, which has become the first state to require that new homes be built with solar panels from 2020.

“As a result, batteries will be required to deliver much more energy and power, as a key source of power; or transfer and store energy while working in more stringent environments than ever.

“This brings big challenges, especially to lead-acid batteries, which can’t operate in a ‘lazy mode’ anymore. The ‘new norm’ requires approximately 10+ times higher flow of energy in and out, much deeper cycling capabilities and much better charge efficiency in a dynamic way (compared to the previous generation of SLI batteries to start the engine in automobiles).

“While the after-market can still generate stable demand for lead-acid batteries in the next decades, we are seeing an urgency for innovation in the lead-acid industry. Otherwise, the market will quickly shift to other disrupting technologies, like lithium-ion.

“With those threats ahead, we see market requests as opportunities to drive the lead-acid industry from development status quo, to pioneering innovation. As one of the most critical components in a battery and the inventor of PE separators, we have been reinventing our technology to support our partners to innovate lead-acid battery technology to a new spectrum, and have a better position in competing and sharing the opportunities in the energy storage space in 2021 and beyond.”

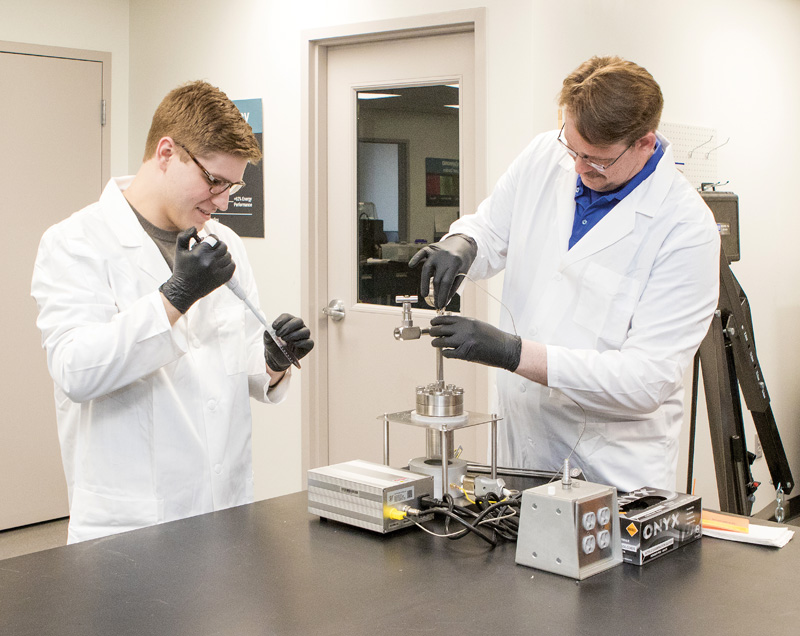

Micheal Everett, COO at Advanced Battery Concepts. The US-firm’s GreenSeal™ technology aims to improve performance and costs for lead-acid batteries.

“Building on more than a century of stable performance and market growth, lead batteries and the lead battery industry has continually risen to the challenges imposed by the expanding energy storage markets and applications. The supply chain and the manufacturing apparatus are in harmony and the channels for distribution of lead batteries make them accessible wherever and whenever they are needed.

“The existence of the secondary lead market, as well as the highly efficient and well-developed recycling infrastructure, have secured lead batteries as the predominant energy storage technology on the planet. And with the upswell of lead battery technology advancements in materials, battery architectures and manufacturability, the future of lead is bright and getting brighter.

“These new technologies truly have the ability to expand markets, putting lead where it previously would not have been considered a fit. The jury has yet to render a verdict on how lead and lithium will share this growth and the opportunities in the future. But one thing that cannot be denied is lead has proven itself and is getting much better. It will continue to succeed based on its merits and will play a critical role in the energy storage footprint around the globe for the long term.”

Maria Pia De Simone, account manager – customer liaison at CAM, which makes industrial equipment for the lead-acid battery industry, in particular lead-oxide ball mills and curing chambers for battery plates.

“We believe both aspects are fundamental in maintaining a strong lead-acid battery industry in the future. I think we all have become more aware of this, ironically because of the COVID-19 pandemic. In fact, as shown in the ILA’s recent social media video and Andy Bush’s presentation at the 17ELBC, lead batteries have had the backs of our health care, communications and transport systems throughout the pandemic.

“It is necessary to inform stakeholders and the general public that lead batteries are more necessary than ever to our daily lives, and in particular that they are ecological. And the way to do this is precisely by developing and implementing new technologies.

“Through the years, through technological advancement, we have consistently reduced gas emissions and electrical consumption because, to paraphrase Clarios CEO Mike Wallace, we obsess about ensuring that what goes into our customers’ batteries is made in the most sustainable way possible.

“We follow with interest the efforts of stakeholders to educate the public about the high recyclability of lead batteries— something that, despite the advancement of lithium-ion technology, makes them far from obsolete. In fact, market indicators project that demand is expected to increase over the next few years, offering many opportunities to our industry to make further advances.”

Roger Miksad, executive vice president, Battery Council International.

“The safety of lead batteries is not in question – they’ve been a reliable and trusted energy source for more than a century. With their 70% market share, they dominate the global rechargeable battery market and play a central role in a sustainable future, with a 99% recycling rate that cannot be matched.

“Energy storage markets are diverse and growing rapidly, and we see great opportunities for lead batteries. Lead battery manufacturers are investing in R&D to improve lead battery performance through innovations such as bi-polar designs and new molecular additives to unlock the full potential of the chemistry. That research is done independently, with universities, and in partnerships with government scientists— such as DOE’s Argonne National Laboratory— to conduct basic research that will lead to enhanced battery performance.