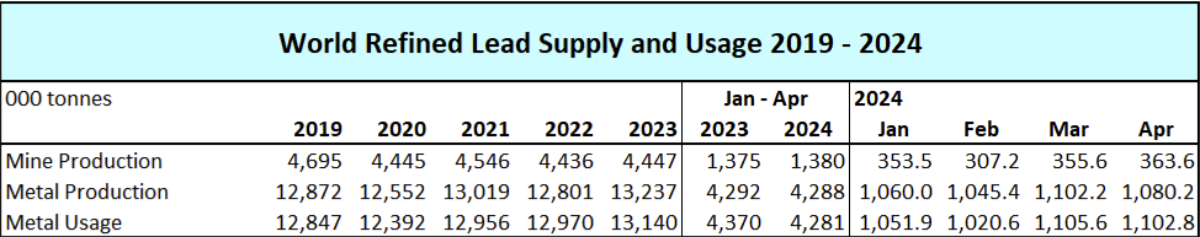

Global supply of refined lead metal continues to exceed demand. In the first four months of 2024, the surplus was 7,000 tonnes, according to data released on Thursday by the International Lead and Zinc Study Group.

It said reported inventories rose by 134,000 tonnes.

World lead mine production rose 0.4% in the period. It was up in Kazakhstan, Peru and Sweden and partially balanced by reductions in Ireland and Portugal.

ILZSG said production of lead metal was down 0.1% in the first four months – largely offset by rises in Bulgaria, Italy, Japan and South Korea. They all saw dips in 2023.

Usage of refined lead metal fell 2%, mainly due to reductions in Europe, Thailand, Türkiye and the US. Usage rose year-on-year in Japan, South Korea and Mexico.

Chinese imports of lead contained in lead concentrates fell 18% in the first four months to 179,000 tonnes after a 15% rise in 2023. Net exports of refined lead metal totalled 12,000 tonnes, a 38,000-ton decline compared to the same period in 2023.

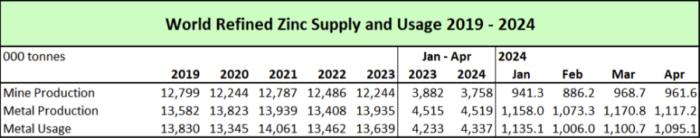

Zinc surplus

The global market for refined zinc metal showed a surplus of 182,000 tonnes in the first four months. Reported inventories increased 152,000 tonnes in the period.

World zinc mine production fell 3.2%, the body reported. This was influenced by dips in Canada, South Africa, Türkiye and Peru. Ireland and Portugal also saw lower production, caused by suspension of mining activity.

Refined metal production was up by a modest 0.1%.

The usage of refined zinc metal worldwide was up 2.5%, according to the data. Rises were recorded in Brazil, China, France, India, South Korea, Taiwan and Thailand. There were falls in Italy, Peru and the US.

Chinese imports of zinc contained in zinc concentrates fell 24% to 564,000 tonnes, while net imports of refined zinc metal came to 139,000 tonnes. This represented a 107,000-ton increase from the first four months of 2023.

All data sources: ILZSG