Updated 12 June 2024

Long-duration energy storage (LDES) will become generally cheaper than lithium-ion batteries, according to BloombergNEF (BNEF)’s inaugural Long-Duration Energy Storage Cost Survey.

It said although most LDES technologies are still early-stage and costly compared to lithium-ion batteries, some already have lower costs for longer durations – or are set to achieve them.

Evelina Stoikou, energy storage senior associate at BNEF and co-author of the report, told BEST in an interview that most batteries deployed today have four hours’ capacity or less for lithium-ion. “And when we look at that four-hour range, most of the long duration technologies are more expensive.” They will continue to be more expensive on that basis, she said.

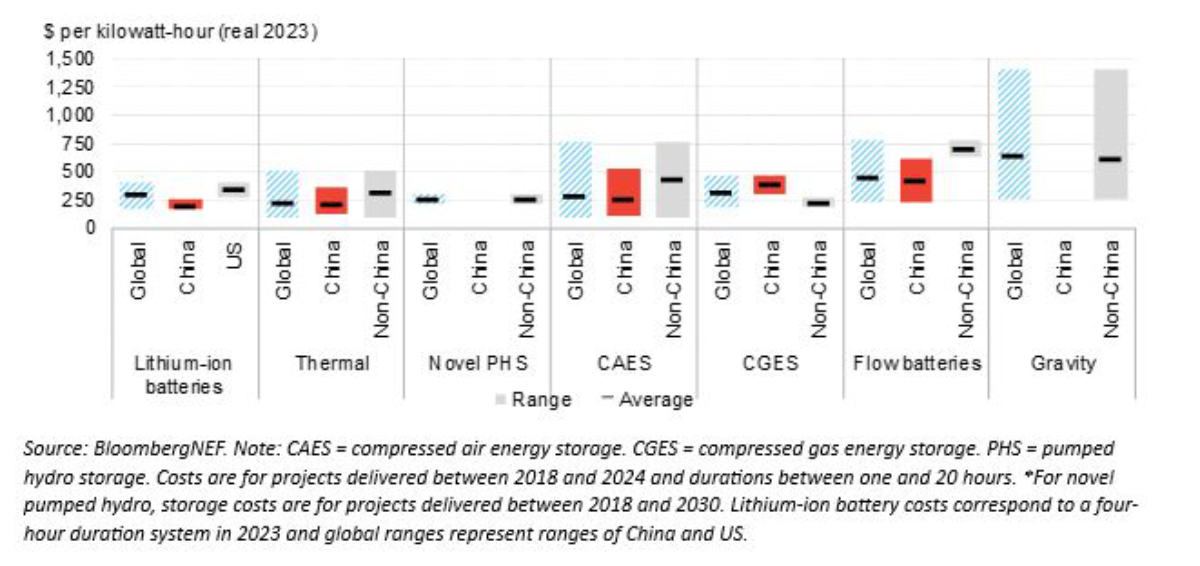

Stoikou added that price drops will be fastest among the maturing and most deployed LDES technologies, such as flow batteries and then compressed air storage. She said the average global cost for flow batteries is $444 per kWh. On a global level, China is slightly lower at $423 per kWh, she said. Non-China flow battery average capex is $701 per kWh. This includes a variety of durations, she said.

She said lithium-ion will dominate in the energy storage market until 2030, after which time LDES will see greater deployment. LDES costs are unlikely to fall as fast as those of lithium-ion batteries this decade, according to BNEF.

It surveyed seven LDES technology groups and 20 technology types in this report. It said the least expensive technologies are already providing cheaper storage than lithium-ion batteries for durations over eight hours.

Thermal energy storage and compressed air storage, for example, had an average capex of $232/kWh and $293/kWh, respectively.

By comparison, lithium-ion systems had an average capex of $304/kWh for four-hour duration systems in 2023, it said. It classes four-hour systems as generally shorter-term storage.

Stoikou said: “What we see is that for certain long-duration technologies, if you look at eight hours and above, some of these technologies are already theoretically more cost competitive compared to lithium-ion.

“And that is because with that the dollar-per-kWh cost of lithium ion, the per-unit cost is flat throughout the duration. So if you need an eight-hour battery system, it would pretty much cost you the equivalent of adding two four-hour batteries.”

BNEF expects the typical time for energy storage assets to discharge or charge will increase and LDES technologies can add more energy storage without adding more power conversion capacity. They are thus seen as a contender to lithium-ion batteries, it said.

BNEF said China leads the way in cost-effectiveness for established technologies like compressed air energy storage, flow batteries, and thermal energy storage. But it added the average capex in non-Chinese markets is 68% higher for compressed air storage, 66% higher for flow batteries and 54% higher for thermal energy storage.

Yiyi Zhou, BNEF’s clean energy specialist and report co-author, said: “The significant cost disparity is largely due to China’s far greater adoption of LDES technologies. While other nations are still in the early stages of commercialising LDES technologies, China is already developing gigawatt-hour scale projects, driven by favourable policies.

“This is particularly true for compressed-air energy storage and flow batteries, where China has set new project size records in the past two years. The rate of LDES installations in China is astounding.”

Stoikou sees an appetite for exploring R&D in Europe and the US to diversify away from constrained supply chains around lithium, nickel and cobalt.

Julia Souder, CEO of the LDES Council, said the report shows LDES is critical to achieving clean energy goals. It is also becoming increasingly competitive with lithium-ion across key applications, she added.

But quick action is required. She said: “…we require specific global and national targets to be set for LDES deployment. This must be backed by supportive policies and market mechanisms to drive adoption and accelerate commercialisation.”

Research body Zhar Research issued a report in May forecasting that the lithium-ion battery market will peak then fall “well within the next 20 years.” It will be replaced by sodium-ion then perhaps aqueous zinc-ion batteries – offering lower cost and at times better safety and performance.