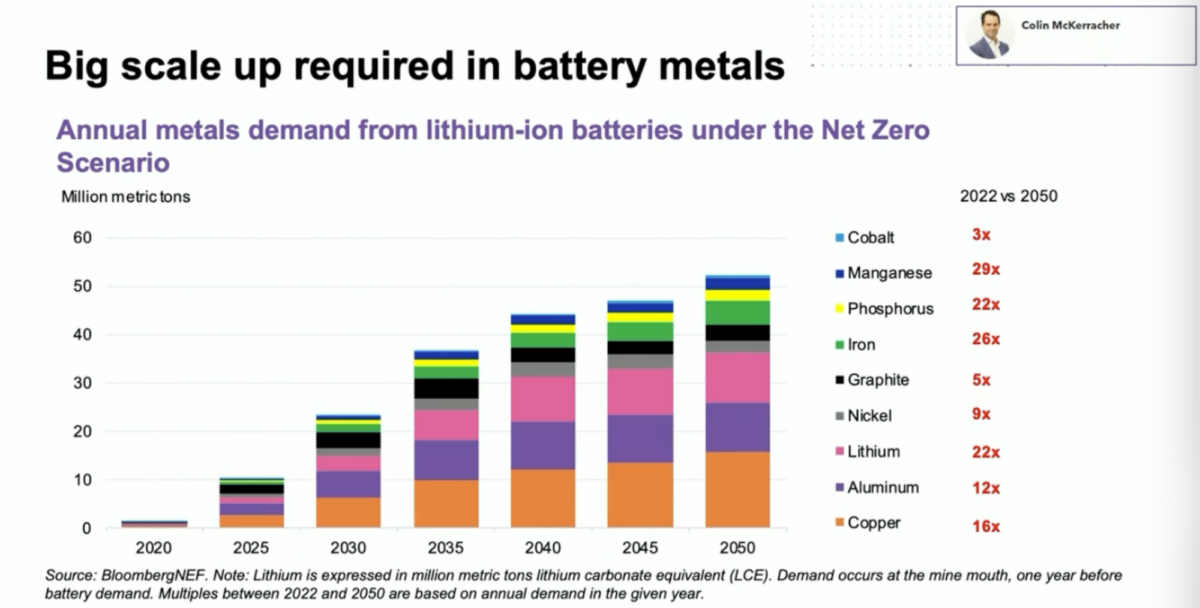

Presenting its Electric Vehicle outlook for 2023, BloombergNEF’s head of transport and storage Colin McKerracher said more investment is needed in upstream battery chain areas. A big scale-up is needed for lithium-ion battery metals to meet demand, he said.

From 2022 to 2050 under its net zero scenario, manganese demand will be 29 times higher, phosphorous 22 times, iron 26 times, while lithium demand will be 22 times up.

Actual battery factory investment totalled $58.9 billion in 2022, which is ahead of forecasts.

Head of EV charging Ryan Fisher said a fully electric vehicle fleet will need 9,000 TWh of electricity by 2050. Electrifying almost all road transport will add 12–14% of global electricity demand, he said.

That will represent a cumulative investment in charging infrastructure of $1.2–1.7 billion by 2040, he said. The charging network is expected to peak in the 2030s for most markets and could be preceded by a rapid growth as operators engage in land grabbing to set up facilities.

EV driving range has been rising 10% a year for the past few years, said McKerracher. The average range for a BEV is now 300 km, and average battery pack size is 60 kWh.

“A significant battery is going into the average vehicle,” he said, adding that BEVs are getting more efficient. Some new models being launched have ranges of over 400 km.

But the growth in range cannot continue unchecked, he said, as there are finite resources. Also, as the charging network is rolled out, there will be no need for ever-increasing ranges.

BNEF presented three scenarios for battery pack prices, including a 16% and 18% learning rate – which correlates the decline in prices with increasing production. That means that price parity between BEVs and ICE vehicles will depend on battery pack prices.

It sees price parity in 2025 ($124/kWh) in Europe for large BEVs and SUVs, and for BEVs in China. In developing countries such as India, parity is forecast for 2031 (medium BEVs and SUVs). It stressed parity will be over a time range rather than any one point in time.

Yayoi Sekine, head of energy storage at BNEF, explored three battery technologies in her presentation: sodium-ion, solid-state and next generation anodes. She notes the many company announcements for 2023 and plans for sodium-ion gigafactories. Although the batteries do not have the same range as lithium-ion batteries, they do not contain lithium. They could therefore offset significant lithium demand in 2035, she said.

She noted how companies are getting closer to commercialising solid-state batteries, with three models: solid oxide, sulfide and polymer.

BNEF forecasts that total EV sales will hit $9 trillion by 2030, rising to $30 trillion in 2040 and $57 trillion in 2050.

Alistair Davidson, director of the Consortium for Battery Innovation, said: “This is an interesting report, and really highlights the demand and supply issues for batteries in the future. This report focuses on batteries in electric vehicles, but similar scenarios are forecast in other applications such as utility and renewable energy storage. Lithium-ion batteries will clearly be a key technology in the future, but it is vital that we can utilise all battery technologies, and ensure that the most suitable technology is used for a given application.”

Image: BNEF says big scale-up required in battery metals